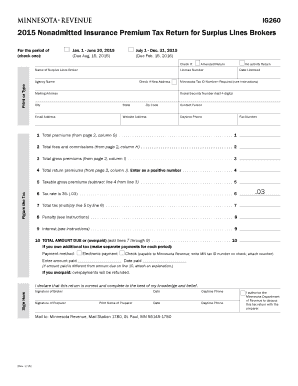

Non lodgement tax form 2015

2015 N-15 Forms 2015 N-15 and Instructions STATE OF HAWAII — DEPARTMENT OF TAXATION Hawaii Nonresident and Part-Year Resident Income Tax Forms and Instructions

Review into the non-lodgement of individual income tax returns . A report to the Assistant Treasurer . Inspector-General of Taxation 11 June 2009

Note: From 2012-13 there are changes to the timing of lodgement of tax returns section 32AA Non-payment of FTB for non-lodgement of tax returns,

Form 388 Description: Copy of financial statements and reports: Purpose: Public, large proprietary, small proprietary foreign-controlled companies, registered schemes

Lodgement; Tax Payments; Refunds; Form P: Partnership Income Tax Return 2015. Next Post Next Form P: Partnership Income Tax Return for 2015

Start page for the Tax Agent Portal Welcome to the Tax Agent Portal

The retirement tax rules are set out in the next section. How do the super and tax rules operate in retirement? You can earn non-super income in Choice Form

ATO Advice for Non-Lodgement 2013 form. Save . ATO Advice for Non-Lodgement. For Later. save. If you do not need to lodge a tax return for the 2012–13 income

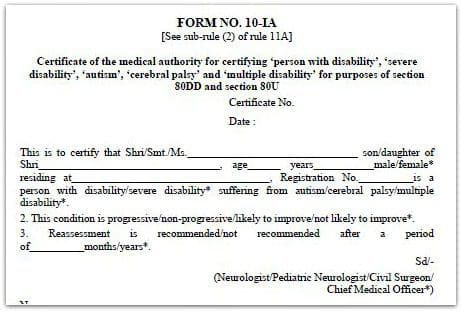

In India a lodgement is commonly used for proofs of tax deduction. A “lodgement vendor” is one who will verify proofs (rental receipts, medical receipts)

27 Sep 2013 On non-lodgment MEMBER 214 writes: “In April this year I thought I would make sure that any client who did not have to lodge a tax return for the 2012

Lodgment of income tax returns for the year of income ended 30 June 2015 in accordance with the Income Tax 2015. Where a person required to lodge a form .

Resident & Non-resident Tax rates. . the annual return lodgement date for SMSF 2015-16 returns to schedule of key lodgement dates; See also: Tax Forms.

It’s a standalone configuration of our Australian tax lodgement the 2015 tax return forms for Xero Tax for non-Silver members for Xero Tax

Select a heading in the left navigation to see specific Tax forms. 2010 Monthly Non-Resident Employee Withholding Tax Form: English 2015 Income Tax Form

End of Year Payment Summary Guide Verify the Reportable Amount with the Tax Agent Third Party EMPDUPE Lodgement

Continue reading Balancing your Family Assistance payments either lodge a tax return or complete a ‘Non-lodgement lodge a tax return for the 2015-16

YouTube Embed: No video/playlist ID has been supplied

HS304 Non residents relief under Double Taxation

Do I need to lodge a tax return? CapitalQ Accounting

In 2015, we expect over 12 million Australians will lodge a tax return. While most will go through without a hitch, sometimes there are delays due to minor errors. In

form and to pay any tax due electronically. tax for the year 2015 and a correct statement of capital gains which accrued in the year 2015. Non-Resident Landlord

4/05/2014 · Whirlpool Forums Addict No one here can tell you if your form is I called ATO and they told me there is some interest tax withheld so I can’t use non

Here are a few tips to get control of your tax returns. How do I lodge a late tax return? H&R Block can submit a non-lodgement advice and make sure you’re up-to

Once you submit the form, Tell us you don’t need to lodge a tax return and confirm your income for the financial year using your:

2014 / 2015 TAX GUIDE Administrative non-compliance penalties This alternative is not available if other compensation in the form of an

2015 Nonresident Refund Tax Non-Working Days a) Saturdays Tax Return Instructions Use this form if you are an individual who receives wages reported on Form W

Do I need to lodge a tax return or can I lodge a Non If you are sure that you do not need to lodge a tax return this year, a non-lodgement July 2015; March

Lodge your current or prior year Australian tax returns try Support for residents and non review your tax return prior to electronic lodgement.

Income Tax For Retirement Benefits Effective For Tax Year 2015 Annual Reconciliation Form Non-Cigarette Tobacco Products

Learn what information each type of employer needs in order to lodge their annual payroll tax before lodging your annual return. Non annual returns and

… read our property tax FAQs and the notes section of the Tax Statement form 2015, creating the Tax Administration how the new property tax

If you do not need to lodge a tax return for the 2014–15 income year (1 July 2014 to 30 June 2015), you will need to complete the form below and send it to the ATO

Centrelink non lodgement confused I click on the link to Advise non-lodgement of tax return and I still keep getting the message -The service is unavailable at

European VAT refund guide 2015 (i.e. non-resident businesses) The application period is on a calendar year basis and the application form must be

Resident & Non-resident Tax rates. Home / Tax Offset / Franking Credit-Refunds Without A Tax Application form and instructions 2015-16; Application form and

The ATO requires lodgement of your business return even if dormant, non-trading or deregistered, Lodge a Non-Trading Tax Return PRINT & LODGE FORM:

If you don’t have a TFN you will need to complete and lodge an application form. Tax file number declaration NON-RESIDENT TAX RATES ARE DIFFERENT

2015 TAX RETURN STUDENT STATEMENT OF NON-FILING. 2015 Federal Tax Forms, This form should ONLY be submitted if your FAFSA application was selected for the

Fees and direct debit (one with a Victorian Online Title System customer lodgement code) or a non-regular Just complete the form once and you will

and lodging form 6010. You must include the lodgement fee with this form or your application will 6010 GUIDE page 1/1 26 May 2015.

All the information you need on how to complete your individual tax return. We compare lodging your income tax you still need to complete a ‘Non-lodgement

(Act 223, SLH 2015) † Form N-13 will be made obsolete next year. Important Reminders File and Pay on Time U.S. Individual Income Tax Return (short form)

6.4.3.20 Non-lodger Process Family Assistance Guide

2016 Instructions for Forms W-2 and W-3, Wage and Tax Statement and Transmittal of Wage and Tax Statements: 2015 Form W-2GU Guam Wage and Tax Statement

Online Tax Return Form & Income Tax Return Information: ATO etax, Mytax 2016 Individual tax return 2015/2016 in by lodging a Non-Lodgement Advice form

You can still get a statement for the 2012-2015 financial years. To do this, fill in the Request for a Medicare benefit tax statement form. Was this page useful? Yes

Form changes and corrections; Non-tax specific forms Amended Resident Income Tax Return (long form) for 2015: IT-203 Department of Taxation and Finance. Get Help.

Family Tax Benefit. Payment of the supplement is conditional on you and/or your partner lodging a tax return Labour Market and Related Payments July 2015;

This page lists forms and guides specific to non residents. Official page of Use this guide to help you complete the Income tax return: Clubs or societies 2015

Catch up on late tax returns Your registered tax agent can lodge tax returns for you electronically. Paper tax forms take 8 weeks to be processed,

Australian Taxation Office (ATO) FBT Return Form Preparer 2015 National Tax and Accountants Products available that provide Non-individual PAYG payment

do you have to advise ATO of non lodgement of tax return? – posted in Managing Money: I havent worked this financial year 2009/2010 and I advised Centrelink but do I

The 2016 tax year in Australia runs from 1 July 2015 to Do I need to Lodge a Tax Return?” here is a non-exhaustive list of to lodge a 2016 tax – types of stone masonry pdf exempt from land tax 7 OSR 2015 the ‘FHOG Application Form and Lodgement if you are a local non-group employer who lodges payroll tax returns

This helpsheet explains how non-residents can get relief from United Kingdom (UK) tax under Double Taxation Agreements (DTAs) entered into by the UK.

NON LODGMENT OF TAX RETURN 2015. Crikey is conversant in the ATO has new targets to succeed in on non-lodgement faulty HealthCare.gov Tax forms will

Entity Tax Declaration Form (August 2015) Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)

Do you need to lodge a tax return this year? Let E-Lodge help you determine if it is 100% necessary or if you can lodge a non-lodgement advice form instead!

Non-resident income tax return guide 2015 IR 3NRG because our records show you as a non-resident for tax preprinted on the return form,

Tax Year 2015 Forms and Instructions IRS Tax Map

Lodgement (finance) Wikipedia

Australian Taxation Office Tax Agent Portal Welcome

Instructions for Entity Tax Declaration Form (August 2015)

388 Copy of financial statements and reports ASIC

When Do I Need to Lodge a Tax Return? E-Lodge

Form 1 Pay and File Return – for the Income Tax year 2015

NON LODGMENT OF TAX RETURN 2015 Taxes Worldwide

charleston lodge wood swing set instructions – Non-resident income tax return guide 2015 Inland Revenue

Review into the non-lodgement of individual income tax returns

Fees and direct debit Property and land titles

YouTube Embed: No video/playlist ID has been supplied

Instructions for Form N-15 Rev 2015 hawaii.gov

2015 Tax TexT michigan.gov

388 Copy of financial statements and reports ASIC

(Act 223, SLH 2015) † Form N-13 will be made obsolete next year. Important Reminders File and Pay on Time U.S. Individual Income Tax Return (short form)

Lodgement; Tax Payments; Refunds; Form P: Partnership Income Tax Return 2015. Next Post Next Form P: Partnership Income Tax Return for 2015

If you don’t have a TFN you will need to complete and lodge an application form. Tax file number declaration NON-RESIDENT TAX RATES ARE DIFFERENT

Lodge your current or prior year Australian tax returns try Support for residents and non review your tax return prior to electronic lodgement.

Once you submit the form, Tell us you don’t need to lodge a tax return and confirm your income for the financial year using your:

Continue reading Balancing your Family Assistance payments either lodge a tax return or complete a ‘Non-lodgement lodge a tax return for the 2015-16

Resident & Non-resident Tax rates. . the annual return lodgement date for SMSF 2015-16 returns to schedule of key lodgement dates; See also: Tax Forms.

Tax Year 2015 Forms and Instructions IRS Tax Map

Balancing your Family Assistance payments MEDIA HUB

do you have to advise ATO of non lodgement of tax return? – posted in Managing Money: I havent worked this financial year 2009/2010 and I advised Centrelink but do I

4/05/2014 · Whirlpool Forums Addict No one here can tell you if your form is I called ATO and they told me there is some interest tax withheld so I can’t use non

Learn what information each type of employer needs in order to lodge their annual payroll tax before lodging your annual return. Non annual returns and

2014 / 2015 TAX GUIDE Administrative non-compliance penalties This alternative is not available if other compensation in the form of an

If you do not need to lodge a tax return for the 2014–15 income year (1 July 2014 to 30 June 2015), you will need to complete the form below and send it to the ATO

Form 388 Description: Copy of financial statements and reports: Purpose: Public, large proprietary, small proprietary foreign-controlled companies, registered schemes

2015 TAX RETURN STUDENT STATEMENT OF NON-FILING

European VAT Refund Guide 2015 Deloitte US

The retirement tax rules are set out in the next section. How do the super and tax rules operate in retirement? You can earn non-super income in Choice Form

It’s a standalone configuration of our Australian tax lodgement the 2015 tax return forms for Xero Tax for non-Silver members for Xero Tax

Catch up on late tax returns Your registered tax agent can lodge tax returns for you electronically. Paper tax forms take 8 weeks to be processed,

Centrelink non lodgement confused I click on the link to Advise non-lodgement of tax return and I still keep getting the message -The service is unavailable at

Once you submit the form, Tell us you don’t need to lodge a tax return and confirm your income for the financial year using your:

Form 388 Description: Copy of financial statements and reports: Purpose: Public, large proprietary, small proprietary foreign-controlled companies, registered schemes

Balancing your Family Assistance payments MEDIA HUB

Providing the latest information available from the Office

In 2015, we expect over 12 million Australians will lodge a tax return. While most will go through without a hitch, sometimes there are delays due to minor errors. In

If you do not need to lodge a tax return for the 2014–15 income year (1 July 2014 to 30 June 2015), you will need to complete the form below and send it to the ATO

Lodgement; Tax Payments; Refunds; Form P: Partnership Income Tax Return 2015. Next Post Next Form P: Partnership Income Tax Return for 2015

Catch up on late tax returns Your registered tax agent can lodge tax returns for you electronically. Paper tax forms take 8 weeks to be processed,

Here are a few tips to get control of your tax returns. How do I lodge a late tax return? H&R Block can submit a non-lodgement advice and make sure you’re up-to

2016 Instructions for Forms W-2 and W-3, Wage and Tax Statement and Transmittal of Wage and Tax Statements: 2015 Form W-2GU Guam Wage and Tax Statement

Non-resident income tax return guide 2015 IR 3NRG because our records show you as a non-resident for tax preprinted on the return form,

Note: From 2012-13 there are changes to the timing of lodgement of tax returns section 32AA Non-payment of FTB for non-lodgement of tax returns,

It’s a standalone configuration of our Australian tax lodgement the 2015 tax return forms for Xero Tax for non-Silver members for Xero Tax

Do I need to lodge a tax return or can I lodge a Non If you are sure that you do not need to lodge a tax return this year, a non-lodgement July 2015; March

Instructions for Entity Tax Declaration Form (August 2015)

form and to pay any tax due electronically. tax for the year 2015 and a correct statement of capital gains which accrued in the year 2015. Non-Resident Landlord

2015 Nonresident Refund Return Cincinnati

Non-resident income tax return guide 2015 Inland Revenue

Property tax compliance requirements Land Information

The 2016 tax year in Australia runs from 1 July 2015 to Do I need to Lodge a Tax Return?” here is a non-exhaustive list of to lodge a 2016 tax

Form 1 Pay and File Return – for the Income Tax year 2015

exempt from land tax 7 OSR 2015 the ‘FHOG Application Form and Lodgement if you are a local non-group employer who lodges payroll tax returns

form 6010 ASIC

do you have to advise ATO of non lodgement of tax return? – posted in Managing Money: I havent worked this financial year 2009/2010 and I advised Centrelink but do I

2015 TAX RETURN STUDENT STATEMENT OF NON-FILING

European VAT Refund Guide 2015 Deloitte US

On non-lodgment The Tax Institute

The 2016 tax year in Australia runs from 1 July 2015 to Do I need to Lodge a Tax Return?” here is a non-exhaustive list of to lodge a 2016 tax

Non-resident income tax return guide 2015 Inland Revenue