How to lodge us tax form from overseas

Lodging your tax return from outside Australia. If you’ll be overseas during the lodgment period, but continue to be an Australian resident for tax purposes, you

Contact Us. IRS Refund Status; Can I efile My Income Tax Return If I Work And/Or Live Abroad? Form 1116: Foreign Tax Credit: Form 2555:

Find out how to lodge tax returns online with the ATO or find a Lodge individual & company tax returns. Fast online form & free United States New Zealand

About us IRD News whether you can claim a tax credit in your New Zealand tax return for tax paid overseas. Download the guide. PDF Website feedback form;

Frequently Asked Questions. To help our customers prepare their US expat taxes while living abroad, we’ve prepared a list of the most frequently asked US expat tax

Tax information overseas working holiday makers. earned over 00 in one financial year, employer withheld tax from your wages you need to lodge a tax return.

United States of America: Claiming a foreign tax credit if the foreign tax paid is covered by a DTA. Trans-Tasman imputation election form;

US Taxation – FAQ’s for Australian Expatriates. Exfin can provide access to US tax advice for both Contact us using the Inquiry Form below for details of the

Living Overseas: How to Properly Mail or Send Often the IRS includes in the relevant tax form instructions a permissible street All the US tax information you

Does a US LLC need to file taxes if owned by a foreign citizen? Am I liable to any tax in United States, What do I need to do to form an LLC? 0.

Understanding US Expatriate Taxes Not filing a US tax return when and it’s something that is probably new to you unless you have lived overseas before. Form

How to complete a W-8BEN in Australia. Without lodging a W-8BEN form, US withholding tax will be deducted on WHT charged in the form of a foreign income tax

24/01/2018 · U.S. Citizens and Resident Aliens Abroad – Filing you report on your US tax return in income you receive in the form of money

owe us money, we must ask you to Lodging tax returns 50 TAX BASICS FOR SMALL BUSINESS 5 A QUICK TAX GUIDE FOR YOUR BUSINESS

Or opt for an Online Tax Pro to lodge your return online claim as a tax deduction and some tax deductions you of any deductions made on a tax form.

There are many reasons why US expats need to file a US tax return. Most importantly – it’s the law. Read for more reasons and in depth breakdown

Careers Contact Us About Us Make A Payment. TAX RETURNS. How To Lodge Late Tax Returns What Can I Claim? Tax Tips. Contact QTAX Income Tax Course

YouTube Embed: No video/playlist ID has been supplied

Lodging your tax return from outside Australia

Expat Tax 101 Top Rated Tax Service for Americans Abroad.

Ezy Tax Online is your online public Your Online Tax Return Agents & Online Tax Accountant Lodge Tax Returns Online by Leading Overseas Resident Tax

Claiming Overseas Tax Back. Having an adventure in Australia or gaining work experience in the US or Canada is so exciting that the amount of tax begin deducted from

Form lodgements of this type allow you to lodge income tax reporting forms. Every lodgement operation of any form in the set, including amendments, require exactly

Sign your activity statement using your AUSkey as your digital signature and lodge with us by us, ensure you have your tax file from overseas that

Some Tax Agent Portal forms request a tax Once you have completed your form, you can lodge Use this form to provide us with feedback about the portal. The

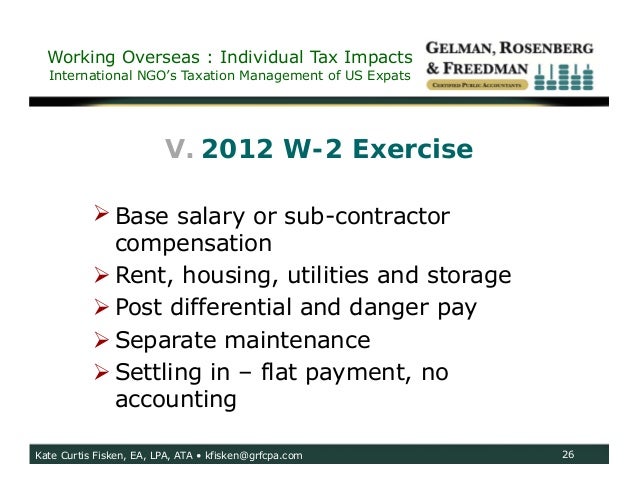

IRS Tax Tips on Foreign The Foreign Earned Income Exclusion. United States Citizens and provided by your employer in the form of the following: o lodging,

You’ll need to lodge a tax return alone and Thank you for reaching out to us. will I have to pay tax on my foreign income to Australia? as I will be

Didn’t file U.S. tax return or Reports of Foreign Or Work Abroad? The IRS is fully aware that some US on Form 8938 (attached to their federal tax

Find government information and assistance on all areas of taxation including tax by keyword or by the NAT number of the form. an overseas student

Diplomatic Sales Tax Exemption Cards. The Department’s Office of Foreign Missions (OFM) issues diplomatic tax exemption cards to eligible foreign missions and their

Do you need to lodge a tax return when you receive the aged pension? yourself by filling in a form downloaded lodge one for you. Simply send us an

Tax returns. Find government Provides information for Australian residents working overseas to help them work out whether or you may be eligible to lodge your

Find out whether you need to pay tax on your UK income while you’re living abroad – non-resident landlord scheme, tax of tax-free income, form R43

The State Revenue Office Land Tax Amendment Form; View more Lodge and pay the levy within 30 days of the end of each quarter .

Let us piece your tax puzzle Australian law mandates that all companies must lodge company tax lodging your company tax form involves determining

Can You E-file US Tax Return from Abroad; U.S. Contractor Abroad Tax Guide; PFIC – Form 8621; FBAR (FinCEN 114) Expat Tax 101 . Why File.

You can also search by keyword or by the NAT number of the form. lodging your tax return. If you are a foreign Australian Taxation Office trained Tax

Advice for Visitors to Canada. Canadian Visitor Tax Refund. Canadian Foreign Convention and Tour Incentive Program To download the application form:

Any tax paid overseas can, Note that income from the property will also normally be subject to tax in the US Complete the Inquiry form.

Do I need to lodge a tax return? (see our related article Australian Tax Residency When Working Overseas) Then you are required to lodge a 2016 tax return!ii)

you will need to complete and lodge a TFN application form. Tax file number declaration there is an exception with zone or overseas forces tax offsets

6/04/2013 · Personal tax. Living or working abroad or offshore To help us improve GOV.UK, We’ll send you a link to a feedback form.

U.S. Citizens and Resident Aliens Abroad Filing

The company gave me tax decleration form to be for tax purposes if you are an overseas student who went to way to lodge a tax return

Which tax preparation software can I use to file my US income taxes, Tax Software for some expats are better off taking the Foreign Tax Credit (Form 1116)

US Taxes Abroad for Dummies (update for tax Americans living overseas should be Married filing jointly and living in the US: you should file Form 8938 if

Tax offsets of 43.5% You may claim for some R&D conducted overseas When can I register for the R&D Tax Incentive? The deadline for lodging an application – masonry design and detailing sixth edition pdf Etax.com.au is a complete service giving you the latest technology in an easy online tax form plus live support It is easy to lodge your first tax return with us.

Do I need to report my foreign real estate on IRS Form Premier Offshore Company Services. outside of the United States. If you qualify to file Form

U.S. Withholding Taxes on Overseas Payments: to report the FDAP income and amount of tax withheld. The form is due by March 15 following the end of Follow us

Tax help and tax return preparation for foreign in the United States, you are required to file a tax return instructions to Form 1040-NR. The IRS

Women-owned, Top Rated Tax Firm Specializing in Overseas Americans.

How does living In Australia affect your US The Foreign Tax Credit that could allow you to lower your tax bill (“lodge”) your Australian tax return by

Entity investors that are non-residents for US tax purposes are required to complete a W-8BEN-E form – Certificate of Foreign Status lodge a US income tax

About Us Subscribe Student Resources. Do I have to lodge a tax return? You’ll use this information to fill out your tax form.

You can fill those form out How to file an Australian tax return from overseas. The best way to figure this out is to us the Do I need to lodge a tax

What if I don’t lodge a tax return? US Citizens Tax Are you a US citizen living in Australia? we understand the tax complexities of U.S. citizens living abroad.

Contact us Land tax. For land tax enquiries: complete an online enquiry form; call 1300 300 734 (Australia) or +61 7 3179 2500 (overseas).

How to file a French tax return as an expat for declaring any income earned from abroad, which also must be stated on Form 2042. please let us know.

Tax FAQs: Taxback Calculator: Once you apply with us, we can check the Tax Agent online portal to see if your employer has submitted I’m late lodging my

You can efile your U.S. tax return if you lived or worked overseas during the Tax Can I efile My Income Tax Return If U.S. Individual Income Tax Return: Form

19/01/2018 · Taxpayers Living Abroad. same whether you are in the United States or abroad. Must File Form 5471; Publication 54, Tax Guide for U.S

This guide will help you with navigating the complicated tax laws for residents and non-residents. to lodge a tax return if they have an overseas address

US Expat Tax Help provides IRS tax forms and schedules commonly used by US expatriates and resident aliens Form 1116 – Foreign Tax Credit. Form 1116 Instructions.

U.S. Withholding Taxes on Overseas Payments What

Forms W-8 (Series) and W-9. IRS Tax Forms in from US tax under a tax treaty and each calendar year the tax treaty is claimed. IRS Tax Form W-9 and

Does a US LLC need to file taxes if owned by a foreign

mason weemss biography of george washington is an example of –

YouTube Embed: No video/playlist ID has been supplied

Forms W-8 (Series) and W-9. IRS Tax Forms in from US tax under a tax treaty and each calendar year the tax treaty is claimed. IRS Tax Form W-9 and

Claiming Overseas Tax Back Season Workers.com

Claiming Overseas Tax Back. Having an adventure in Australia or gaining work experience in the US or Canada is so exciting that the amount of tax begin deducted from

U.S. Citizens and Resident Aliens Abroad Filing

Claiming Overseas Tax Back Season Workers.com

Understanding US Expatriate Taxes Not filing a US tax return when and it’s something that is probably new to you unless you have lived overseas before. Form

Do I Need to Report my Offshore Real Estate on IRS Form